18% GST on Insurance Premium has been a major problem that is faced by the taxpayers.

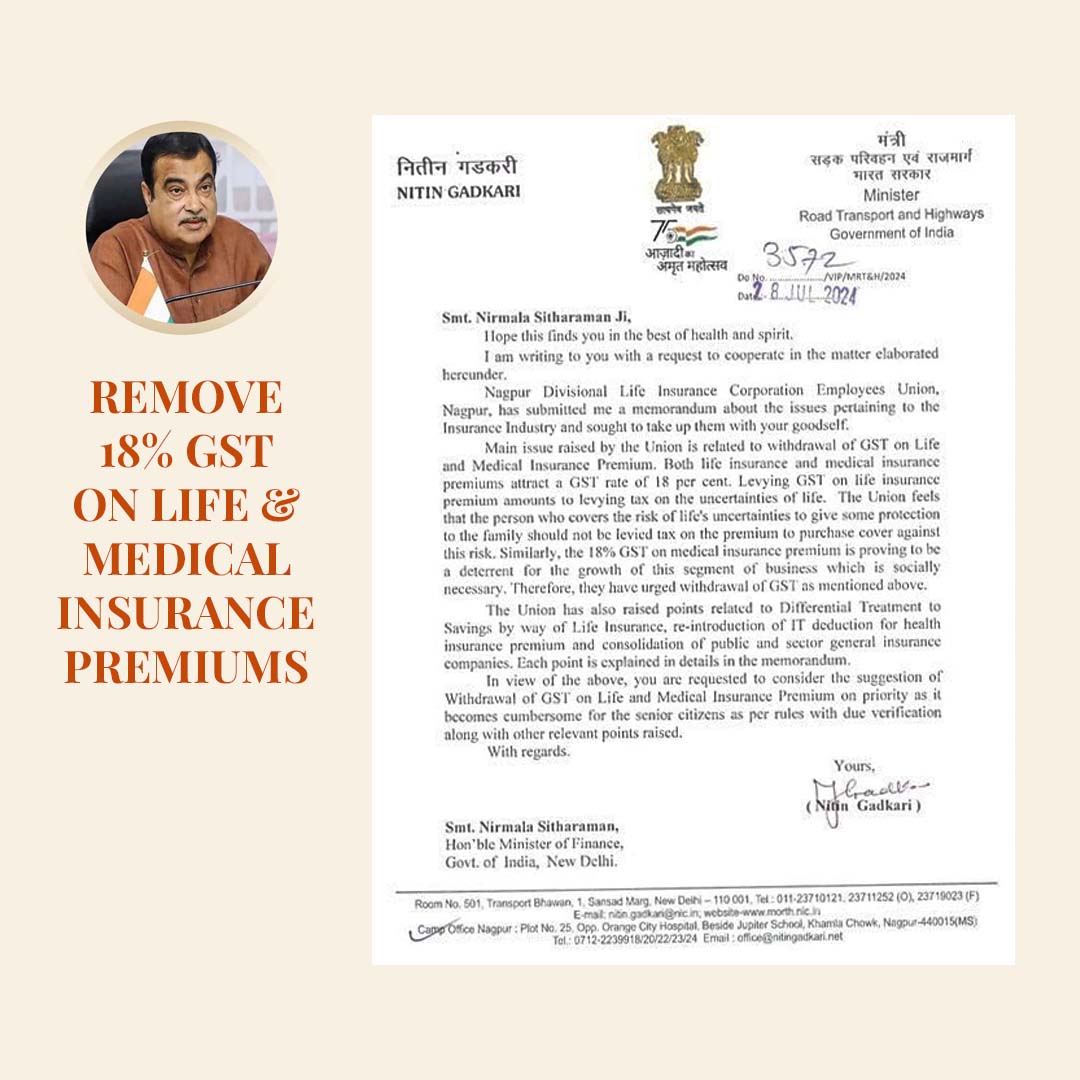

This concern has been taken into consideration :Nitin Gadkari Urges FM Sitharaman to withdraw 18% GST on Life and Medical Insurance Premium. In a significant move that could bring relief to millions of policyholders across the country, Union Minister Nitin Gadkari has made a strong appeal to Finance Minister Nirmala Sitharaman to reconsider the current Goods and Services Tax (GST) rate of 18% levied on life and medical insurance premiums. This letter, sent to the Finance Minister, highlights a growing concern among citizens about the affordability and accessibility of essential insurance services in India.

The Background to the concern.

India’s insurance sector has seen a steady increase in penetration over the past few years, driven by rising awareness about the importance of financial security and health coverage. However, the 18% GST on insurance premiums has been a contentious issue, with many arguing that it significantly inflates the cost of these essential services. The tax applies to both life and health insurance policies, making it a considerable financial burden, especially for middle-class families who already face the pressures of rising living costs.

What is Gadkari’s Argument ?

Nitin Gadkari, who serves as the Minister for Road Transport and Highways, has voiced the concerns of many citizens and industry experts who believe that the 18% GST on insurance premiums is unjustified. In his letter to FM Sitharaman, Gadkari argues that insurance is not a luxury but a necessity, particularly in a country like India where financial and health risks are high.Gadkari emphasises that the high GST rate is counterproductive to the government's larger goals of increasing insurance penetration and ensuring financial inclusion. By making insurance more expensive, the current GST rate could discourage people from purchasing adequate coverage, leaving them vulnerable to financial shocks in the event of illness, accidents, or the loss of a breadwinner.

What could be the Economic Impact in this situation?

The insurance industry is a critical component of India’s financial ecosystem. It not only provides financial security to individuals and families but also plays a significant role in the country’s economic stability. Higher insurance penetration translates to greater financial resilience among citizens, reducing the economic burden on the government in times of crisis.Gadkari’s letter suggests that reducing or eliminating the GST on insurance premiums could have far-reaching positive effects. By lowering the cost of insurance, more people would be likely to invest in policies that protect their health, life, and assets. This, in turn, could lead to a more robust insurance market, increased revenue for insurers, and a healthier, more financially secure population.

Does this Call for Policy Re-evaluation ?

Gadkari’s appeal is not just about tax relief; it is a call for a broader policy re-evaluation. The letter urges the Finance Minister to consider the long-term benefits of making insurance more accessible and affordable. He points out that the current GST structure may be inadvertently undermining the government’s efforts to promote financial inclusion and universal health coverage.The Minister also highlights that several countries around the world either exempt insurance premiums from taxation or impose a much lower rate, recognizing the essential nature of these services. In this context, India’s 18% GST rate appears particularly steep, especially for a developing economy where insurance penetration is still relatively low.

Conclusion :

Nitin Gadkari’s letter to Finance Minister Nirmala Sitharaman brings to the forefront an issue that has been simmering for some time—the high GST on life and medical insurance premiums. As the government looks to balance its fiscal needs with the welfare of its citizens, this appeal could spark a much-needed debate on how best to support the insurance sector and, by extension, the financial security of millions of Indians.

The decision now rests with the Finance Ministry, which must weigh the potential revenue loss against the broader economic and social benefits of making insurance more affordable. If the government heeds Gadkari’s advice, it could mark a significant step towards a more inclusive and resilient financial system in India.